Our monthly roundup of research insights for the recreation and tourism industries

This month’s newsletter presents some current findings of interest from our recent projects. Additionally, it focuses on some of the topics and issues that we’ve been hearing about in conferences and meetings with mountain resort partners this spring. We welcome your input and feedback at info@rrcassociates.com.

US Snowsports Visits and Kottke Study

At the NSAA National Convention and Trade Show in early May, RRC Associates presented preliminary findings from the Kottke National End of Season Survey, an annual ski resort operator survey used to track a variety of ski industry benchmarks, including skier and snowboarder visits.

Findings include:

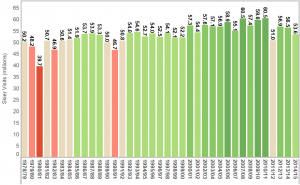

- Impacted by challenging weather, skier visits were preliminarily estimated to be down 5.2 percent at US resorts this season, to 53.6 million visits. In longer-term perspective, the 2014/15 season was also down 3.8 percent from the five-year average (2010/11-2014/15).

Visits were preliminarily estimated to have been down in all regions, including slight drops in the Northeast (-0.8 percent), Southeast (-1.4 percent), and Rocky Mountains (-2.1 percent), and more substantial declines in the Pacific Southwest (-6.4 percent), Midwest (-9.3 percent), and Pacific Northwest (-36.3 percent).

Visits were preliminarily estimated to have been down in all regions, including slight drops in the Northeast (-0.8 percent), Southeast (-1.4 percent), and Rocky Mountains (-2.1 percent), and more substantial declines in the Pacific Southwest (-6.4 percent), Midwest (-9.3 percent), and Pacific Northwest (-36.3 percent).- In longer-term perspective, the 2014/15 season was also down 3.8 percent from the five-year average (2010/11-2014/15). The Southeast (+6.1 percent), Northeast (+2.3 percent), and Rockies (+1.7 percent) each exceeded their five-season averages, while the Midwest (-3.5 percent), Pacific Southwest (-22.9 percent), and Pacific Northwest (-39.2 percent) each fell below their five-season averages.

- The challenges of the season were apparent when you consider that the 2014/15 winter was preliminarily estimated to have had the lowest snow in 24 years of the Kottke Study in the Pacific Southwest, Pacific Northwest, and Rocky Mountains, and the second-lowest snowfall on record for the country as a whole. Snowfall in the 2014/15 season was 70 percent below the 24-season average in the Pacific Southwest, 51 percent below average in the Pacific Northwest, 25 percent below average in the Rocky Mountains, and 11 percent below average in the Midwest, while climbing slightly above average in the Northeast (up 3 percent) and Southeast (up 5 percent).

Based on the preliminary survey results, ski area operators remain optimistic for next winter, but for now many are focused on opening for summer and are planning a variety of activities and events to bring visitors to their communities.

Summer

Summer business is a very hot topic for ski resort companies, as they look to expand their revenue streams and bring more business during the warm months of the year. Considering how to attract visitors in the summer makes sense, given that it is the primary season when people travel and go on vacation in this country. Kids are out of school, roads and passes are clear of snow and ice, companies expect employees to take time off, people are looking to escape the heat of the city, and the 97% of Americans who don’t ski or snowboard become a part of the target market.

Indeed, DestiMetrics data shows the summer of 2015 shaping up to be a strong one for Western mountain communities, at least as measured by occupancy rates and revenue at hotels and condos. New waterparks and ziplines are opening across the country, and festivals, adventure races, and concerts are everywhere in ski country. According to research that RRC Associates did for NSAA, three-quarters of ski areas offer summer activities, with the most popular being hiking, scenic chairlift rides, weddings/meeting/family reunions, and cross-country mountain biking. These activities and events bring visitors to the mountain community, helping to fill hotel beds, make cash registers in retail stores ring, and bring hungry diners into restaurants.

Indeed, DestiMetrics data shows the summer of 2015 shaping up to be a strong one for Western mountain communities, at least as measured by occupancy rates and revenue at hotels and condos. New waterparks and ziplines are opening across the country, and festivals, adventure races, and concerts are everywhere in ski country. According to research that RRC Associates did for NSAA, three-quarters of ski areas offer summer activities, with the most popular being hiking, scenic chairlift rides, weddings/meeting/family reunions, and cross-country mountain biking. These activities and events bring visitors to the mountain community, helping to fill hotel beds, make cash registers in retail stores ring, and bring hungry diners into restaurants.

The more varied the offerings of summer activities, the more attractive the destination is to travelers. The diversification into four season recreation is healthy for the long term local economy, though typically not as lucrative for the ski area as the winter season – at least not yet.

NSAA’s National Millennial Study

2015 could well be considered the year of the “Millennial.” This year marked the first time individuals born after 1980 became the largest living generation in the U.S., a distinction long previously held by Baby Boomers. Their growing prominence and influence as consumers and in the workforce has made them the target of a great deal of research over the past few years. Some of that research has shed light on meaningful generational differences (e.g., income disparities and significant differences in rates of home ownership), but myths persist; most existing research does little to accurately inform the snowsports and recreation industries specifically about how to boost participation levels from this age group.

Motivated by the need to increase Millennial participation and engagement in snowsports, RRC Associates worked with NSAA to conduct an in depth study of this market segment during the 2014/15 season. Final results from NSAA’s National Millennial Study were unveiled at the national convention in San Francisco in early May. The study included qualitative interviews with young people in select U.S. markets, as well as a large national quantitative survey of 21 to 35 year olds. The purpose of the study was to understand how young adults view downhill skiing and snowboarding:

- If they currently participate in snowsports, what barriers prevent them from skiing/snowboarding more frequently?

- If they don’t ski or snowboard, what perceived obstacles preclude them from trying the sport?

Over the next few months NSAA will be providing its members with detailed results from the project. In the meantime, selected highlights from the study are presented below.

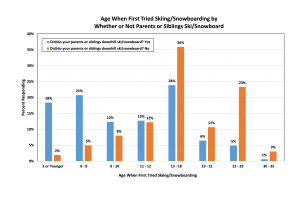

- On average, Millennials who currently ski or snowboard indicated they first tried the sport at around 13 years of age. Perhaps not surprisingly the age of first trial was significantly different for those who indicated their parents or siblings skied/snowboarded. These individuals typically tried the sport at around 11 years of age, whereas those without skiing or snowboarding family members tried the sport at around 17 years of age, with 26 percent of this group indicating trial didn’t occur until after 21 years of age.

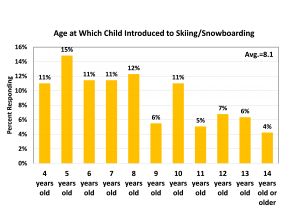

- In order to better understand how young families come to the sport, the study documented at what age young parents introduce their child to skiing or snowboarding. On average, parents indicated they introduced their child to the sport at 8 years of age. Sixty seven percent of parents introduced their child to the sport on skis. Of that number, 25 percent later migrated to snowboarding. Similarly, of the 33 percent who first tried the sport on a snowboard, 25 percent later switched to skis. These levels of crossover have important implications for the future growth of snowboarding and will be analyzed in more detail in the full report.

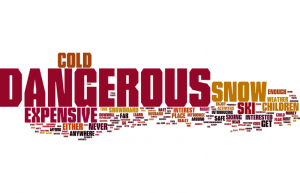

- Parents who indicated they didn’t intend to introduce their child to skiing or snowboarding were asked their specific reason for not doing so. A large number cited the perceived danger of the sport as the reason they wouldn’t introduce their child to skiing/snowboarding. For purposes of attracting young new families to the sport, maximizing the perceived fun of skiing and snowboarding while minimizing the risks likely represents a significant messaging challenge for the industry, as illustrated in the word cloud.

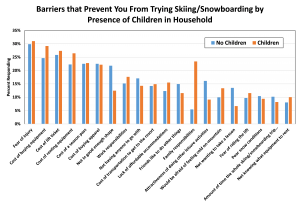

- Non-skiers/snowboarders were asked what barriers prevent them from trying skiing/snowboarding. The number one most often cited barrier was “fear of injury.” After fear of injury, a variety of cost factors loomed large. “Cost of buying equipment,” “cost of lift ticket,” “cost of renting equipment,” and “cost of a season pass” rounded out the top five barriers for participation. If children were present in the household “family responsibilities” would make it into the top five. For those without children “not being in good enough shape” and “attractiveness of doing other leisure activities” were cited with greater frequency.

Ski areas need to be aware of and adapt to meet the general patterns and expectations of Millennials, and doing so will make snowsports more attractive to all generations of participants. Further, RRC Associates believes that many of the findings from the snowsports-related research may have applications to other recreational and outdoor activities working to attract more young adults and Millennial participants.

Diversity

Diversity in mountain tourism has always been an important topic, but one that has recently intensified with the emphasis on Millennials, who are the most racially diverse generation in US history. Several recent panels with resort executives have centered on the issue of broadening racial and ethnic diversity in snowsports, which is crucial to the growth of snowboarding and skiing.

However, other types of diversity are important to consider as well – gender, age, geography, family makeup, and more. Increasingly, more conversation is happening around diversifying the customer base related to their level of participation in snowsports – or understanding the less frequent and less passionate snowrider. Some mountain resorts are transitioning from merely ski areas to broader year-round, mountain lifestyle resorts, in part to expand their appeal to a wider audience. For these destinations, being more inclusive also means becoming more attractive to those visitors who do not ski or snowboard, or at least not on every day of their vacation.

However, other types of diversity are important to consider as well – gender, age, geography, family makeup, and more. Increasingly, more conversation is happening around diversifying the customer base related to their level of participation in snowsports – or understanding the less frequent and less passionate snowrider. Some mountain resorts are transitioning from merely ski areas to broader year-round, mountain lifestyle resorts, in part to expand their appeal to a wider audience. For these destinations, being more inclusive also means becoming more attractive to those visitors who do not ski or snowboard, or at least not on every day of their vacation.

A ski resort primarily attracts skiers and snowboarders, but a lifestyle resort appeals to a broader range of potential visitors – some of whom might ski a little, but might also be looking for other things to do. Appealing to non-skiers in the winter makes a destination more attractive to larger groups of families or travelers, and can also help a destination transition to attracting more visitors in the summer.

At the same time, filling lodging rooms with people who are not buying lift tickets, while healthy for the broader destination economy, has potential financial downside for the ski resort company. One thing we have seen this winter is high occupancy levels in hotels and condos, but average to below average levels of snowsports visits. This finding indicates that visitors are doing things other than sliding on the snow during their stay. The interrelationship between these factors highlights the importance of having solid intelligence on what these non-skiers are doing while visiting, and how the destination can better serve their needs now and in the future.

In our opinion, it is positive for the long-term health of mountain destinations to diversify their visitor base in all aspects: race, gender, age, geography, level of interest in snowsports, and other factors.

Beginner Conversion

The NSAA Beginner Conversion Dashboard program has wrapped up the 2014/15 season with excellent results. An overview of the initial season of the study was presented at the NSAA National Conference earlier this month. The research program intends to help ski areas monitor and track first time and beginner skiers and snowboarders, including likelihood to return (both to the individual ski areas as well as the sport in general), migration patterns across different ski areas, reasons for dropping out, and calculating a true conversion rate for each participating ski area.

One of the clear findings from this inaugural year of the project is just how high the intentions are of first-timers to return to the sport: 68% intend to return the same season at least 1 to 5 times. In addition, 55% answered with a score of 10 (1-10 scale) that they would continue to ski and ride as a life-long sport. Overall, as an industry, we deliver an exceptional experience to our first-time visitors. Yet, the questions still remain, what happens to our guests after their first trial? Why do only 17% become active core participants? If we had clear answers to these questions, we could determine very specific strategies to address these challenges and ultimately improve our conversion rate. The NSAA Beginner Conversion Study attempts to answer these questions and provide your individual resort and the entire industry with data-driven intelligence to further understand beginner skiers and snowboarders.

One of the clear findings from this inaugural year of the project is just how high the intentions are of first-timers to return to the sport: 68% intend to return the same season at least 1 to 5 times. In addition, 55% answered with a score of 10 (1-10 scale) that they would continue to ski and ride as a life-long sport. Overall, as an industry, we deliver an exceptional experience to our first-time visitors. Yet, the questions still remain, what happens to our guests after their first trial? Why do only 17% become active core participants? If we had clear answers to these questions, we could determine very specific strategies to address these challenges and ultimately improve our conversion rate. The NSAA Beginner Conversion Study attempts to answer these questions and provide your individual resort and the entire industry with data-driven intelligence to further understand beginner skiers and snowboarders.

Upcoming Conferences

Here are some upcoming conferences and meetings that we’ll be attending. Hope to see you there!

ASSQ 2015 Annual Convention, Mont Saint-Sauveur, June 2 to 4, 2015

Colorado Ski Country USA 52nd Annual Meeting, Boulder, CO, June 11, 2015

TTRA 46th Annual International Conference, Portland, OR, June 15 to 17, 2015

NSAA Downhill Bike Park Summit, Winter Park, CO, June 23 to 24, 2015

Sail America Industry Conference, Newport, RI, June 22 to 24, 2015

Article Library

To read our archive of our articles from the NSAA Journal, visit the Article Library on our website.

back to blog